- LIMITED PREMIUM ACCESS -

“The year end brings no greater pleasure than the opportunity to express to you season’s greetings and good wishes.

May your holidays and new year be filled with joy.”

— Charles Dickens

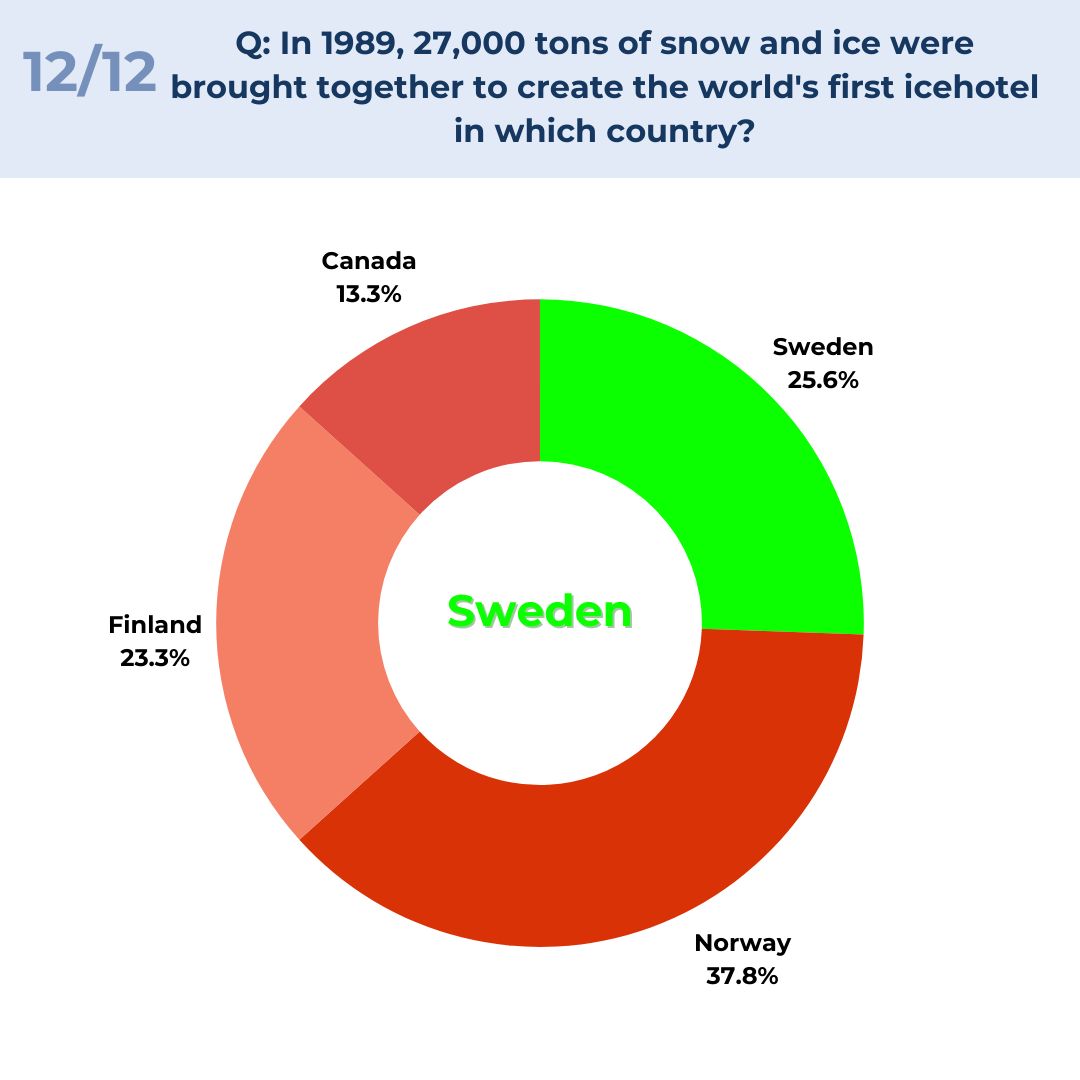

FRIDAY TRIVIA

MARKET REPORT

WEATHER 20/20 REPORT

AGRICULTURE

WINTER PLANNING REDUCES CATTLE STRESS

CATTLE CYCLE NEARING PEAK

VITAMIN A SUPPORTS CATTLE PERFORMANCE

FINANCE

DAILY REPORTING

CATTLE ON FEED OUTLOOK

FIVE FINANCIAL PLANNING PITFALLS

METALS MIXED ON INFLATION

Join in on the fun!

Cast your vote below and stay tuned for the answer next Friday!

Scroll down for last week’s answer

Scroll Down for Last Week's Results— (12/12)

Close

350.05

Previous

349.79

Change

0.26 ▲

Thursday, December 18

AUCTION SUMMARY

OKC West Livestock

8,162 El Reno, OK

Wednesday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 430.00-490.00 | 400-500 lbs | 420.00-490.00 |

| 600-700 lbs | 355.00-440.00 | 500-600 lbs | 370.00-425.00 |

| 700-800 lbs | 340.00-380.00 | 600-700 lbs | 321.00-380.00 |

| 800-900 lbs | 327.50-353.00 | 700-800 lbs | 310.00-342.00 |

| 900-1000 lbs | 308.00-324.75 | 800-900 lbs | 302.00-319.50 |

Hub City Livestock

5,829 Aberdeen, SD

Wednesday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 447.00-510.00 | 500-600 lbs | 400.00-462.50 |

| 600-700 lbs | 390.00-440.00 | 600-700 lbs | 357.00-415.00 |

| 700-800 lbs | 377.50-410.50 | 700-800 lbs | 337.00-349.00 |

| 800-900 lbs | 366.00-374.00 | 800-900 lbs | 314.00-320.00 |

| 900-1000 lbs | 324.50-349.50 | 900-1000 lbs | 291.75-305.00 |

Huss Livestock

5,391 Kearney, NE

Wednesday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 453.00-516.00 | 500-600 lbs | 415.00-463.00 |

| 600-700 lbs | 384.00-424.00 | 600-700 lbs | 365.00-411.00 |

| 700-800 lbs | 361.00-392.50 | 700-800 lbs | 345.50-376.50 |

| 800-900 lbs | 340.00-361.50 | 800-900 lbs | 310.00-330.00 |

| 900-1000 lbs | 325.00-350.00 | 900-1000 lbs | 297.00-301.50 |

CHICAGO MERCANTILE EXCHANGE LIVESTOCK FUTURES SETTLEMENT

Thursday

| Live Cattle | Change | Feeder Cattle | Change | ||

| Dec | 228.425 | 1.875 ▼ | Jan | 340.275 | 1.250 ▼ |

| Feb | 228.400 | 1.150 ▼ | Mar | 334.600 | 1.725 ▼ |

| Apr | 228.150 | 0.975 ▼ | Apr | 333.175 | 1.850 ▼ |

CHICAGO BOARD OF TRADE GRAIN FUTURES SETTLEMENTS

Thursday

| Corn | Change | Soy Beans | Change | ||

| Mar | 4.4450 | 0.0400 ▲ | Jan | 10.5225 | 0.0600 ▼ |

| May | 4.5225 | 0.0450 ▲ | Mar | 10.6200 | 0.0675 ▼ |

| Jul | 4.5800 | 0.0450 ▲ | May | 10.7325 | 0.0675 ▼ |

KANSAS CITY BOARD OF TRADE

Thursday

| Wheat | Change | ||||

| Mar | 5.1700 | 0.0925 ▲ | |||

| May | 5.2925 | 0.0900 ▲ | |||

| Jul | 5.4175 | 0.0825 ▲ | |||

ESTIMATED DAILY CATTLE SLAUGHTER

| Thursday | 123,000 | Wednesday |

| Week Ago (est) | 123,000 | Steer & Heifer: 97,000 |

| Year Ago (act) | 122,000 | Cow & Bull: 21,000 |

| Wk To Date (est) | 472,000 | |

| Last Week (est) | 484,000 | |

| Last Year (est) | 484,000 |

Thursday, December 18

5 AREA WEEKLY ACCUMULATED WEIGHTED AVG CATTLE PRICE

| As of 10:00 am | Head Count | Avg Weight | Avg Price |

| Live Steer | 661 | 1,617 | 228.22 |

| Live Heifer | 570 | 1,292 | 229.28 |

| Dressed Steer | - | - | - |

| Dressed Heifer | - | - | - |

DAILY ESTIMATED CUTOUT VALUES

| 600-900# | Choice | Select | Choice/Select Spread |

| Current Cutout Values: | 357.28 | 343.97 | 13.31 |

| Change from prior day: | +1.19 ▲ | -2.46 ▼ |

DAILY CATTLE SLAUGHTER

| Thursday | 123,000 | Wednesday |

| Week Ago | 123,000 | Steer & Heifer: 97,000 |

| Year Ago (act) | 121,581 | Cow & Bull: 21,000 |

| Week To Date | 472,000 | |

| Same Period Last Week | 484,000 | |

| Same Period Last Year | 483,643 |

Thursday, December 18

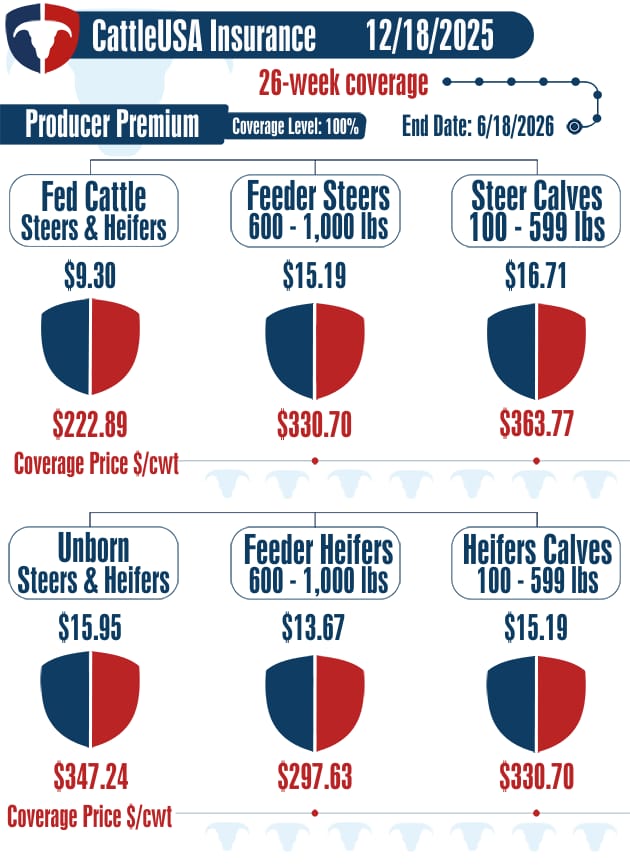

CattleUSA Insurance Partner Logic Ag Marketing Commentary

Before we go off into the weeds on tomorrow's report expectations, I want to bring some light to the pork cutout. I'm starting to notice some "slipage" in product pricing, which could be a short term fluke, or could become a pattern. I don't like the trend in the bellies or hams, so I'm getting a little on edge. If you lifted your hedges on that possible "V bottom," you're already ahead of the market by $6. Use this rally to set a floor on April hogs. LRP is preferred given basis seasonals, but a put works too if you have to. I'm not in a freak out sell it all to zero state of mind, but I don't like this week's action as much as last week's.

Now on to your favorite time of the month- Report Day. The following are only estimates, so who knows what DC will throw at us tomorrow.

- Cattle on Feed 98% compared to Nov 1st 2024

- Placements 92% compared to November last year

- Marketings 88% compared to November last year

— 1 less day of marketings compared to last November

As far as my thoughts on the report, I don't like that we could see a report showing more placements than marketings, but do we even believe their numbers anyway? Many traders take the next two weeks off, so this report might do absolutely nothing to the markets, or the volatility could be extreme with fewer traders. Flip your coin, because again, the USDA's guesses against what the Futures Markets have priced in is something to watch, but also the USDA's guesses against the estimates listed above. I'm going to take the stance that Cash and Kills will matter more, and this week hasn't been a ball of fire in the cash space and not expecting a huge kill to finish the month either.

-Fat cattle kill at 123,000 vs 123,000 a week ago and 121,000 a year ago

-Choice boxes up 1.19 to $357.28 and select down 2.46 to $343.97 for a spread of 13.31 on 89 loads

-CME feeder index(Feeder LRP Settlement) for 12/17 came in at $350.05

-Fed Cattle LRP’s ending last week settled at $227.90

-Hog kill at 495,000 vs 494,000 a week ago and 485,000 a year ago.

-Afternoon Pork reported down 1.11 at $97.43 on 183 loads

-CME lean hog index on 12/16 reported at 83.87

-CME pork cutout index on 12/17 reported at 98.61

-LRP’s ending 12/18 settled at approximately $83.88

Click here to connect with a CattleUSA Insurance representative

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.

Review our full disclaimer at https://www.logicag.com/disclaimer

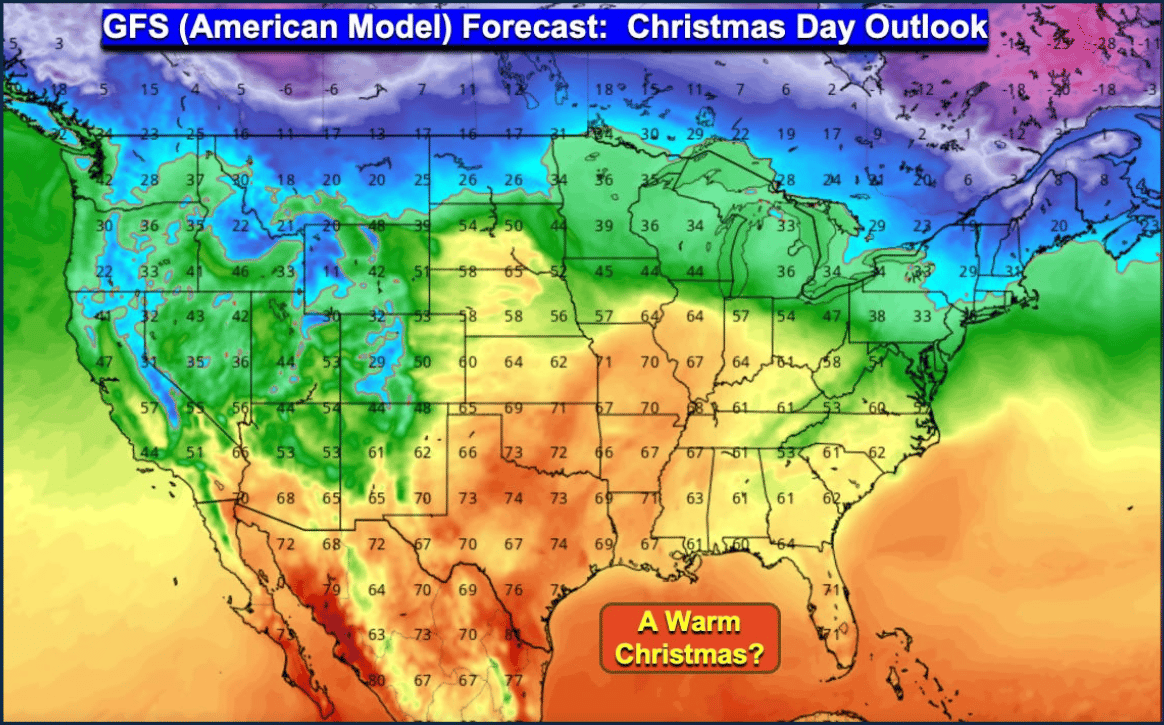

CHRISTMAS WARM-UP

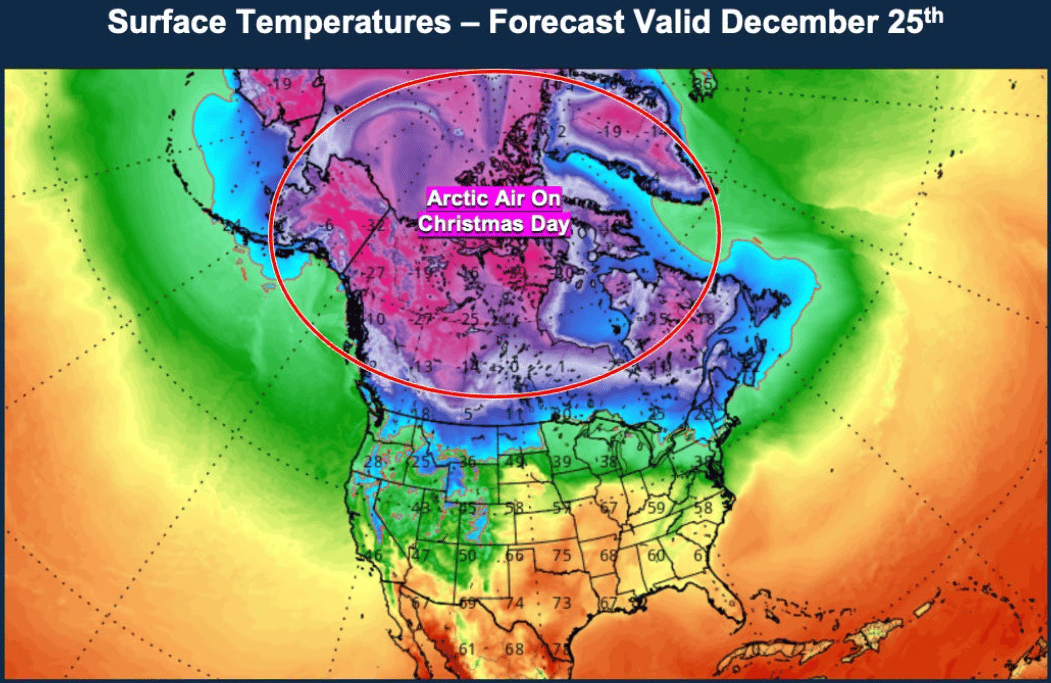

As we head into the official start of winter, the key takeaway is that this year’s LRC is beginning to reveal its structure, even as important details continue to sharpen. Wind, temperature swings, and shifting storm tracks are all part of the same evolving pattern, and the signals we’re tracking now will become increasingly actionable in the weeks ahead.

The GFS model shows a stronger warm up with 71 degrees in Kansas City on Christmas Day. Let’s see how these models trend.

There is still Arctic air on the North America side of the Northern Hemisphere:

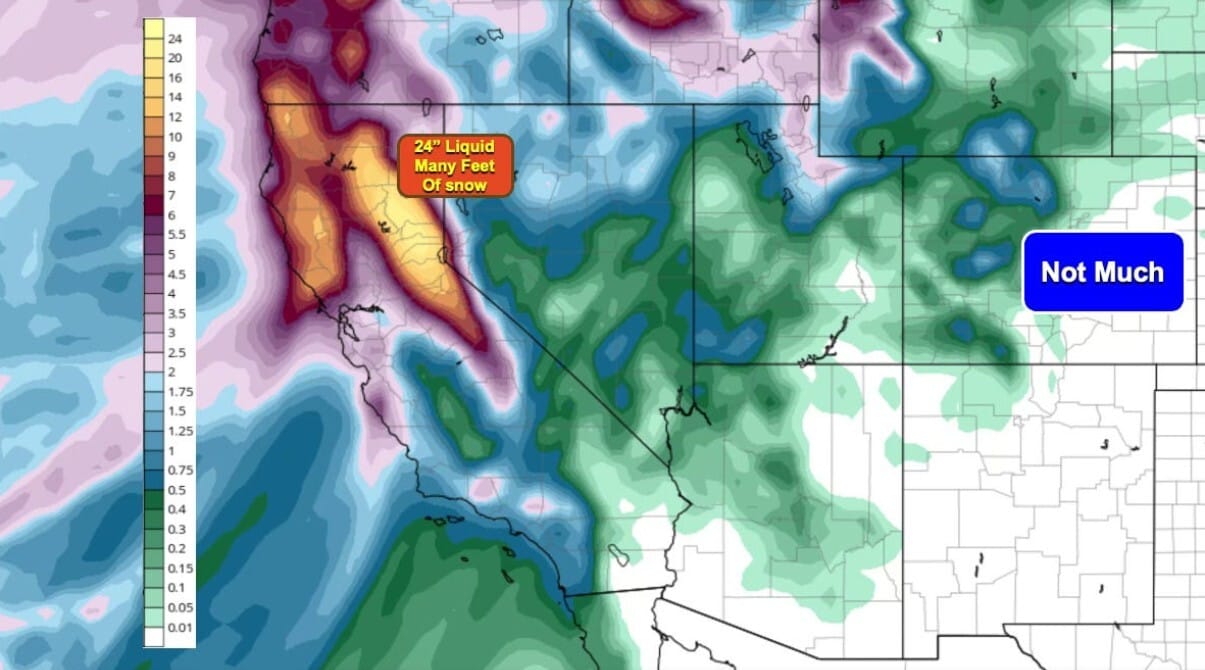

Take a look at the latest data for the California storm. At this point, the model is likely overdoing the extreme end of the precipitation forecast, including indications of up to two feet of rain now through the 25th. While that specific amount is unlikely, it highlights the potential for a high-impact system, especially with an elevated flooding risk in the foothills of the Sierra Nevada.

This is a situation we’ll continue to monitor closely as the pattern becomes better defined and the guidance comes into better agreement.

It’s important to note that the LRC is still coming into focus. As we move deeper into the winter pattern, the signal sharpens, and within the next couple of weeks the model becomes significantly more accurate for planning and decision-making.

CattleUSA has teamed up with Weather 20/20 to bring you exclusive access to long-range weather forecasts using their patent-pending LRC methodology. Plan ahead with confidence and stay ahead of the weather—now at a special discounted rate for CattleUSA users!

Last Trivia Voting Results— (12/12)

Winter Planning Reduces Cattle Stress

Iowa Beef Center highlights three free resources to help manage cold-weather stress in cattle, covering winter grazing versus confinement, managing effective temperature and wind exposure, and adjusting nutrition using body condition scoring. Proper planning improves cow health, calving success, and herd performance. read more here

Cattle Cycle Nearing Peak

Cattle prices remain near record highs as tight supplies persist, but OSU experts say the market hasn’t yet hit its cyclical bottom. Slow herd rebuilding, drought recovery, and rising production costs will keep supplies tight, supporting prices before an eventual downturn as the cycle turns. read more here

Vitamin A Supports Cattle Performance

Vitamin A plays a key role in gene expression, immunity, growth, and reproduction in cattle. Deficiencies—common in winter or drought—can reduce weight gain, fertility, and calf health. Proper mineral programs and timely supplementation help cattle fully express their genetic potential. read more here

Thursday, December 18

| MARKETS | PRICE | CHANGE | PERCENT |

| DOW | 47,951.85 | + 65.88 | 0.14% ▲ |

| S&P 500 | 6,774.76 | + 53.33 | 0.79% ▲ |

| NASDAQ | 23,006.36 | + 313.04 | 1.38% ▲ |

| Russell 2000 | 2,507.87 | + 15.57 | 0.62% ▲ |

| Gold | 4,361.00 | - 12.90 | 0.29% ▼ |

| Silver | 65.38 | - 1.53 | 2.28% ▼ |

| Bitcoin | 85,287.00 | - 830.00 | 0.96% ▼ |

| Crude Oil | 55.94 | + 0.13 | 0.23% ▲ |

Cattle On Feed Outlook

The Dec. 1 Cattle on Feed report is expected to show little change, as fewer placements are offset by longer days on feed. Historically low cattle numbers, early calf marketing, strong October prices, and the closed Mexico border continue to shape feedlot dynamics. read more here

Five Financial Planning Pitfalls

As the new year begins, avoiding common money mistakes can strengthen long-term finances. Key risks include reacting to political shifts, lacking emergency reserves or insurance, neglecting worst-case planning, avoiding professional guidance, and not openly discussing finances to build accountability and confidence. read more here

Metals Mixed On Inflation

Gold steadied near $4,369 as softer U.S. inflation lifted hopes for Fed rate cuts, while silver fell on profit-taking after record highs. Oil prices rose on supply risks tied to Venezuela and Russia, and base metals firmed as rate-cut expectations supported demand despite cautious sentiment. read more here

CattleUSA Daily Podcast:

What kind of bug hates Christmas?

A bah humbug

-/

Want more CattleUSA? Check out our socials!

-

Got thoughts on what we should tweak next? Reply to this email or message us at [email protected]—we’d love to hear from you!