- LIMITED PREMIUM ACCESS -

“Yet my heart loves December’s smile

As much as July’s golden beam;

Then let us sit and watch the while

The blue ice curdling on the stream.”

— Emily Brontë

MONDAY MEME

MARKET REPORT

WEATHER 20/20 REPORT

AGRICULTURE

NORTHEAST AG SCHOOLS QUIETLY LEAD

FARMERS WARN BIOSECURITY GAPS

EXPLORING MURRAY GREY CATTLE

FINANCE

DAILY REPORTING

GRAIN MARKETS SLIDE FRIDAY

GOLD SURGES AMID GLOBAL UNCERTAINTY

CRYPTO FIRMS NEAR BANKING

They can be hard to see, so give the tires a kick and honk the horn just in case 😂

Did you see a meme that made you laugh this week? DM @cattleusa.media on Instagram to share with the community!

+ follow @cattleusa.media & help us get to 1,500 followers!

Close

346.77

Previous

345.47

Change

1.3 ▲

Friday, December 12

AUCTION SUMMARY

Ogallala Livestock

6,230 Ogallala, NE

Thursday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 400-500 lbs | 528.00-555.00 | 300-400 lbs | 497.50-520.00 |

| 500-600 lbs | 443.00-525.00 | 400-500 lbs | 458.00-505.00 |

| 600-700 lbs | 405.00-458.50 | 500-600 lbs | 401.00-448.00 |

| 700-800 lbs | 360.00-386.00 | 600-700 lbs | 360.50-383.50 |

| 800-900 lbs | 345.00-353.00 | 700-800 lbs | 332.00-352.00 |

Farmers and Ranchers Livestock

4,313 Salina, KS

Thursday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 400-500 lbs | 490.00-537.50 | 400-500 lbs | 440.00-475.00 |

| 500-600 lbs | 445.00-505.00 | 500-600 lbs | 375.00-432.00 |

| 600-700 lbs | 380.00-433.00 | 600-700 lbs | 352.00-371.00 |

| 700-800 lbs | 349.00-391.00 | 700-800 lbs | 323.00-350.00 |

| 800-900 lbs | 335.00-352.00 | 800-900 lbs | 309.00-326.00 |

Billings Livestock Commission

3,115 Billings, MT

Thursday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 300-400 lbs | 600.00-645.00 | 300-400 lbs | 460.00-555.00 |

| 400-500 lbs | 492.50-590.00 | 400-500 lbs | 435.00-492.50 |

| 500-600 lbs | 421.00-482.50 | 500-600 lbs | 370.00-442.00 |

| 600-700 lbs | 389.00-424.00 | 600-700 lbs | 331.00-377.00 |

| 700-800 lbs | 364.00-380.00 | 700-800 lbs | - |

CHICAGO MERCANTILE EXCHANGE LIVESTOCK FUTURES SETTLEMENT

Friday

| Live Cattle | Change | Feeder Cattle | Change | ||

| Dec | 229.800 | 0.575 ▼ | Jan | 339.100 | 4.300 ▼ |

| Feb | 229.550 | 1.400 ▼ | Mar | 334.075 | 3.600 ▼ |

| Apr | 229.400 | 1.275 ▼ | Apr | 333.225 | 3.350 ▼ |

CHICAGO BOARD OF TRADE GRAIN FUTURES SETTLEMENTS

Friday

| Corn | Change | Soy Beans | Change | ||

| Dec | 4.3150 | 0.0375 ▼ | Jan | 10.7675 | 0.1675 ▼ |

| Mar | 4.4075 | 0.0575 ▼ | Mar | 10.8675 | 0.1600 ▼ |

| May | 4.4900 | 0.0525 ▼ | May | 10.9700 | 0.1525 ▼ |

KANSAS CITY BOARD OF TRADE

Friday

| Wheat | Change | ||||

| Dec | 4.9875 | 0.1675 ▼ | |||

| Mar | 5.1800 | 0.0425 ▼ | |||

| May | 5.3050 | 0.0400 ▼ | |||

ESTIMATED DAILY CATTLE SLAUGHTER

| Friday | 105,000 | Thursday |

| Week Ago (est) | 115,000 | Steer & Heifer: 101,000 |

| Year Ago (act) | 115,000 | Cow & Bull: 22,000 |

| Wk To Date (est) | 589,000 | |

| Last Week (est) | 590,000 | |

| Last Year (est) | 604,000 |

Friday, December 12

5 AREA WEEKLY ACCUMULATED WEIGHTED AVG CATTLE PRICE

| As of 10:00 am | Head Count | Avg Weight | Avg Price |

| Live Steer | 35,195 | 1,568 | 228.12 |

| Live Heifer | 17,108 | 1,386 | 227.80 |

| Dressed Steer | 5,642 | 1,024 | 353.61 |

| Dressed Heifer | 1,131 | 890 | 353.92 |

DAILY ESTIMATED CUTOUT VALUES

| 600-900# | Choice | Select | Choice/Select Spread |

| Current Cutout Values: | 357.44 | 344.22 | 13.22 |

| Change from prior day: | -0.67▼ | +0.76▲ |

DAILY CATTLE SLAUGHTER

| Friday | 105,000 | Thursday |

| Week Ago | 115,000 | Steer & Heifer: 101,000 |

| Year Ago (act) | 115,388 | Cow & Bull: 22,000 |

| Week To Date | 589,000 | |

| Same Period Last Week | 590,000 | |

| Same Period Last Year | 604,032 |

When cattle prices finally bounce back, most producers’ minds go straight to optimism, not labeling law. In this episode, host Lauren Moylan and John Campbell walk through a sharp rebound in the sale barns at La Junta, Riverton, and Dodge City, why light calves are once again knocking on October highs, and what that could mean heading into grass turnout. Then the conversation takes a hard turn into one of the industry’s most emotional topics: Mandatory Country of Origin Labeling. John Campbell lays out why mCOOL has become a “sacred cow,” why he doubts it will significantly change consumer behavior, and how imported beef, food labeling laws, and real-world grocery decisions collide with the way producers think the world works.

Takeaways:

Recent sales in La Junta, Riverton, and Dodge City show a strong rebound, with light calves in many cases back near October highs.

Feeder and calf prices on suitable turnout cattle jumped $30–$40 per head in a matter of weeks in some weight classes.

John Campbell expects tight supplies of light cattle and seasonal grass demand to support even higher prices into spring.

Despite recent volatility and “bad news,” a lot of pessimism has been taken out of the cattle market for now.

John Campbell views mCOOL as a “good idea,” but not the number one issue the beef industry should be willing to die on.

He argues most consumers do not truly shop by country of origin; they buy on habit, price, and convenience more than label fine print.

The U.S. imports a large share of its food, including the majority of fruits, vegetables, and almost all seafood, and consumers rarely check those origins.

Labeling is already highly regulated; adding mandatory country-of-origin language risks even more complexity, enforcement, and tiny unreadable print.

Lauren Moylan raises concerns about current “Product of USA” rules that allow imported beef slaughtered and packaged domestically to wear a U.S. label.

Both agree that the bigger strategic question is whether mCOOL would actually shift consumer behavior enough to justify the cost and regulatory burden, especially when the industry still needs imported lean beef and steady demand at the meat case.

Have a topic you want to hear discussed? Use the button below to send us your request and tune in to CattleUSA TV on YouTube to see the answer 🤠

*Do not include personal details like addresses, passwords, financial information or other sensitive data*

Friday, December 12

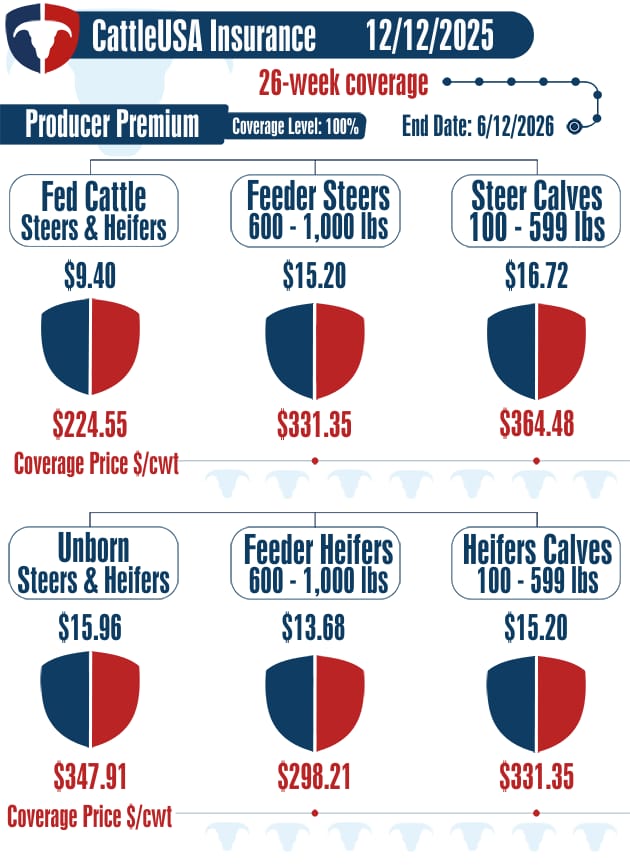

CattleUSA Insurance Partner Logic Ag Marketing Commentary

As you know, I try to end each week on a positive note. There's no reason to ruin the next two days if we don't have to. So let's get this out of the way and give Little Brother the credit they deserve. Great job Cyclones. You accomplished the sweep, something I never thought possible, so enjoy your wins. Yes, Christmas in some of our families will be difficult this year, as we listen to them brag and brag and brag. But remember, they're family, not friends. I've been told we have to love them, even if they make it difficult. So be nice, and be proud of them. They've come along ways in a short time.

To finish up the week, obviously the cash cattle market got some pep in it's step this week with a range of $222-$232.50. Great job Kyle!! Feeder cattle also put some money on in the barns, with yearlings jumping $30/cwt or more in the last 20 days. This has been a wild ride and I'm glad you're experiencing the volatility in the correct direction again. Calves also went crazy this week with several new records being set on 6 and 7 weight steers. This market in the last 60 days has given the bears and the bulls the opportunity to make some money or lose a bunch. It has given an opportunity to buy or sell at great prices relative to history, and has given many of us heartburn at different times. Nothing better than a free market doing free things, even after the attempted market manipulation by the government.

Hogs, as mentioned, look solid. Keep an eye on that 100 day moving average Monday. Product and kills make me want to believe we'll blow right through that but they'll sneak up on a trader quick.

Seth thinks the grains suck more than the Hawkeyes since the Hawkeyes can at least rebound a little bit. He's right, that was a pathetic rally, which I can only hope resumes after the holidays. Consider using this dip next week to get your corn and meal bought. It could be a long hard winter and grains feel undervalued at the moment.

Last but not least, if you forgot to pull your Prime Rib roll out of the freezer for Christmas, get it in the fridge asap. If you can't afford Prime, consider a Choice roll or a ham. They are also very tasty and a great way to celebrate baby Jesus. If your family is 75% Cyclones like mine, take a Select or some flank steak, they've had a good enough year already. Have a great weekend, and stay warm.

-Fat cattle kill at 105,000 vs 115,000 a week ago and 115,000 a year ago

-Choice boxes down .67 to $357.44 and select up .76 to $344.22 for a spread of 13.22 on 120 loads

-CME feeder index(Feeder LRP Settlement) for 12/11 came in at $346.77

-Fed Cattle LRP’s ending last week settled at $221.06

-Hog kill at 477,000 vs 476,000 a week ago and 472,000 a year ago.

-Afternoon Pork reported down .63 at $98.21 on 282 loads

-CME lean hog index on 12/10 reported at 82.57

-CME pork cutout index on 12/11 reported at 96.85

-LRP’s ending 12/12 settled at approximately $82.80

Click here to connect with a CattleUSA Insurance representative

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.

Review our full disclaimer at https://www.logicag.com/disclaimer

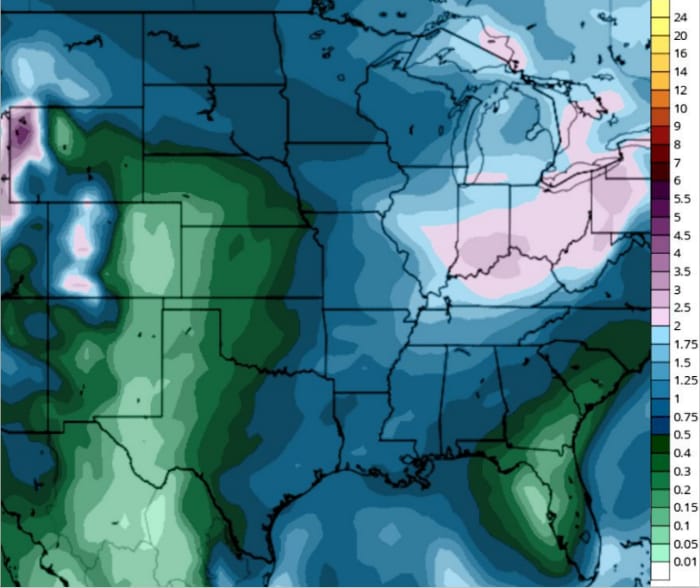

● 0.50”-1” of rain, melted snow will occur from the Dakotas to WCB to east TX, southeast USA and Tennessee Valley Most precipitation for the WCB occurs after December 20th.

● The ECB has a chance to see 1”-3” rain/melted ice, snow

● NE to west TX will see 0.10”-0.50”

CattleUSA has teamed up with Weather 20/20 to bring you exclusive access to long-range weather forecasts using their patent-pending LRC methodology. Plan ahead with confidence and stay ahead of the weather—now at a special discounted rate for CattleUSA users!

Northeast Ag Schools Quietly Lead

Northeast land-grant universities punch above their weight, driving diversified agriculture, high-value production, and major research investment despite small farms and high land costs. Dense populations, strong funding, and cross-disciplinary models are reshaping ag education, technology adoption, and resilience nationwide. read more here

Farmers Warn Biosecurity Gaps

Iowa farmer Sarah Tweeten highlights growing biosecurity threats facing U.S. agriculture, from herbicide-resistant pigweed to aflatoxin, bird flu, and African swine fever. A new Farm Journal Foundation report urges stronger ag research funding, warning that food security is national security. read more here

Exploring Murray Grey Cattle

Murray Grey cattle, developed in Australia, offer calving ease, docile temperament, grass efficiency and strong carcass quality. Ranchers report success in regenerative and grass-finished systems, though results vary by genetics and region, making careful fit and sourcing essential. read more here

Friday, December 12

| MARKETS | PRICE | CHANGE | PERCENT |

| DOW | 48,458.05 | - 245.96 | 0.51% ▼ |

| S&P 500 | 6,827.41 | - 73.59 | 1.07% ▼ |

| NASDAQ | 23,195.17 | - 398.69 | 1.69% ▼ |

| Russell 2000 | 2,551.46 | - 39.15 | 1.51% ▼ |

| Gold | 4,328.20 | + 15.20 | 0.35% ▲ |

| Silver | 62.08 | - 2.51 | 3.89% ▼ |

| Bitcoin | 90,319.00 | - 2,319.00 | 2.50% ▼ |

| Crude Oil | 57.46 | - 0.14 | 0.24% ▼ |

Grain Markets Slide Friday

Grain futures weakened Friday with corn and soybeans posting sharp losses as funds sold heavily and markets tested key technical support. Soybeans fell on concerns over slowing Chinese demand and South America’s coming harvest. Livestock was mixed, with cattle easing and hogs holding firm. read more here

Gold Surges Amid Global Uncertainty

Gold prices have surged to record highs as central banks and investors seek protection from geopolitical risk, dollar dependence and rising debt. Strong official buying, weaker confidence in fiat currencies, and expectations for rate cuts are driving a structural shift toward gold as a reserve and hedge asset. read more here

Crypto Firms Near Banking

The OCC conditionally approved national trust bank charters for several major crypto firms, including Circle and Ripple, allowing them to custody assets and process payments under federal oversight. While not full banks, the move brings crypto closer to traditional finance and has raised concerns from banking trade groups. read more here

CattleUSA Daily Podcast:

Let this week be a new and refreshing start for you.

Aim high. Go for your dreams!

-

Want more CattleUSA? Check out our socials!

-

Have thoughts on what we should tweak next? Reply to this email or message us at [email protected]—we’d love to hear from you!