- LIMITED ACCESS -

If you missed yesterday’s market recap, upgrade to Premium for daily coverage and stay informed on the ups and downs of the cattle market.

“Perseverance and spirit have done wonders in all ages.”

— George Washington

MONDAY MEME

MARKET REPORT

WEATHER 20/20 REPORT

AGRICULTURE

FLORIDA BOARD BOOSTS CATTLE GENETICS

EMBRYOS BOOST COMMERCIAL HERD EFFICIENCY

UDDER QUALITY IMPACTS CALF PROFITS

FINANCE

DAILY REPORTING

CATTLE CHOP, AWAIT CASH BREAKOUT

EXPORTS KEEP CORN PRICES SUPPORTED

DEMAND LIFTS CROPS, HOGS SLIDE

Gotta do what ya gotta do 😅

Did you see a meme that made you laugh this week? DM @cattleusa.media on Instagram to share with the community!

+ follow @cattleusa.media & help us get to 1,500 followers!

Close

373.91

Previous

373.87

Change

0.04 ▲

Friday, February 13

Napoleon Livestock

4,181 Napoleon, ND

Thursday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 400-500 lbs | 537.50-620.00 | 400-500 lbs | 492.50-515.00 |

| 500-600 lbs | 473.00-537.50 | 500-600 lbs | 417.00-490.00 |

| 600-700 lbs | 405.00-465.00 | 600-700 lbs | 380.00-430.00 |

| 700-800 lbs | 375.00-419.00 | 700-800 lbs | 359.00-388.00 |

| 800-900 lbs | 350.00-374.00 | 800-900 lbs | 341.00 |

Mitchell Livestock

3,920 Mitchell, SD

Thursday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 472.00-492.00 | 500-600 lbs | 445.00 |

| 600-700 lbs | 410.00-461.00 | 600-700 lbs | 357.50-398.00 |

| 700-800 lbs | 389.50-410.00 | 700-800 lbs | 343.00-373.75 |

| 800-900 lbs | 350.00-381.50 | 800-900 lbs | 318.50-351.00 |

| 900-1000 lbs | 330.00-360.50 | 900-1000 lbs | 314.00-335.00 |

Mobridge Livestock

3,766 Mobridge, SD

Thursday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 490.00-532.50 | 400-500 lbs | 498.00-525.00 |

| 600-700 lbs | 416.00-464.00 | 500-600 lbs | 422.50-455.00 |

| 700-800 lbs | 373.00-411.00 | 600-700 lbs | 397.00-432.50 |

| 800-900 lbs | 351.00-364.25 | 700-800 lbs | 342.50-383.00 |

| 900-1000 lbs | 334.00-340.50 | 800-900 lbs | 340.00 |

CHICAGO MERCANTILE EXCHANGE LIVESTOCK FUTURES SETTLEMENT

Friday

| Live Cattle | Change | Feeder Cattle | Change | ||

| Feb | 243.075 | 0.575 ▲ | Mar | 366.150 | 0.425 ▲ |

| Apr | 240.625 | 0.025 ▼ | Apr | 363.450 | 0.175 ▼ |

| Jun | 236.150 | 0.100 ▼ | May | 359.425 | 0.475 ▼ |

CHICAGO BOARD OF TRADE GRAIN FUTURES SETTLEMENTS

Friday

| Corn | Change | Soy Beans | Change | ||

| Mar | 4.3175 | 0.0050 ▲ | Mar | 11.3300 | 0.0425 ▼ |

| May | 4.4200 | 0.0025 ▲ | May | 11.4850 | 0.0375 ▼ |

| Jul | 4.5000 | 0.0025 ▲ | Jul | 11.6050 | 0.0325 ▼ |

KANSAS CITY BOARD OF TRADE

Friday

| Wheat | Change | ||||

| Mar | 5.4250 | 0.1150 ▼ | |||

| May | 5.5375 | 0.1225 ▼ | |||

| Jul | 5.6725 | 0.1125 ▼ | |||

ESTIMATED DAILY CATTLE SLAUGHTER

| Friday | 86,000 | Thursday |

| Week Ago (est) | 85,000 | Steer & Heifer: 93,000 |

| Year Ago (act) | 102,000 | Cow & Bull: 22,000 |

| Wk To Date (est) | 540,000 | |

| Last Week (est) | 535,000 | |

| Last Year (est) | 556,000 |

Friday, February 13

5 AREA WEEKLY ACCUMULATED WEIGHTED AVG CATTLE PRICE

| As of 10:00 am | Head Count | Avg Weight | Avg Price |

| Live Steer | 200 | 1,675 | 241.00 |

| Live Heifer | 194 | 1,200 | 243.00 |

| Dressed Steer | - | - | - |

| Dressed Heifer | - | - | - |

DAILY ESTIMATED CUTOUT VALUES

| 600-900# | Choice | Select | Choice/Select Spread |

| Current Cutout Values: | 364.47 | 363.42 | 1.05 |

| Change from prior day: | -0.37▼ | +0.39▲ |

DAILY CATTLE SLAUGHTER

| Friday | 86,000 | Thursday |

| Week Ago | 85,000 | Steer & Heifer: 93,000 |

| Year Ago (act) | 101,725 | Cow & Bull: 22,000 |

| Week To Date | 540,000 | |

| Same Period Last Week | 535,000 | |

| Same Period Last Year | 556,470 |

Join us for a fast-paced, 30-minute webinar where we'll break down key crop insurance updates for 2025–2026 and help you understand important coverage decisions in an increasingly unstable market.

In this session, you'll learn:

✔ Where crop insurance is headed

✔ Why more producers are stacking coverage

✔ How MPCI, ECO and SCO work together in real scenarios

✔ What policy options can strengthen your protection

✔ Planning considerations and reminders to keep top of mind

CattleUSA Insurance Partner Logic Ag Marketing Commentary

I used to like shopping, but only if I was shopping for dogs, trucks, or feeder cattle. Now I want to say that I hate shopping for all 3. Some of these dog breeders are morons. No Karen, I don't want to get on a waiting list for your 2027 pups, I want the one you advertised with a photo on your website, that you're now saying is unavailable. And it used to be fun haggling with car salesmen, just trying to get them down further and further. Now a days, you have to sit there an extra half a day to sign paperwork after you agreed on price, while they try selling you underbody coating and an overpriced detailing package.

I probably shouldn't have said I hate feeder cattle shopping right now, because it's still fun going to the barns. What is becoming more of a struggle is buying quality without much of a hope of a decent roi on that investment. Buying bred heifers and bulls right now is also nerve racking to those ranchers needing replacements. But you know who's looking at the worst ROI right now? The packers. Since cash cattle trade was disappointing this week, let's do some Friday afternoon cocktail napkin math.

• Mr Packer is buying a carcass today for $3.78

• Mr Packer is selling boxed beef for an estimated $3.70

• Since they're only getting a ~60% meat yield off that carcass, they need to average $6.30/lb off meat just to break even on their purchase price.

• Yes they sell hides, ofal, and so many different byproducts, but they still have costs and risks. If I were to use industry estimates printed recently, for them to print a breakeven, cash fat cattle purchases need to average $228 Live FOB.

• No, I'm not saying we should all take less money because we feel bad for them. It's a big market that belongs where its at because of things that happened in the past. Back then it was a market that traded those levels for reasons that existed then. The market, as it always has, is doing its job to make the supply meet the demand. I'm just stating that right now is not a great time to be at this level of the industry.

Is the next step down in the chain much better?

• Buy a 850# steer at yesterday's 374 index settlement and I'm $3,179 deep before freight and processing

• I'm still set on using $1 cost of gain given I'm using the bank's money to play at this high stakes poker table. If I plan to take that steer to 1600# pay weight, I'll have another $750/hd into him. Simple math says I'm looking to break even on this bet at $245 cash at the end of August.

• To get a measily 5% ROI, I'm looking to make $196/hd and need to trade these boys at $2.57 cash later this summer. We better hope demand is strong and there's truly no cattle left to get that to happen.

Grass cattle and grow yards are in the same situation.

• A 625# steer at $425 gets you started with a $2,656 investment.

• If your cost of gain is $1.10, it takes an additional $357/hd to get him to 850#

• With that 850# steer breaking even at $355, you need to see his cash sale hit $372 to pick up that 5% ROI.

• If you're this person, you better hope I get the $2.57 cash fats in August or my banker might not let me pay $372 for your yearling.

And is it much different for the neighbor up here who paid $5,200 for some bred heifers and already slipped one calf? Not in the least bit.

• If I use $1300 on average to wean a 500# calf these days, and put that heifer on a 5 year note, my payment each year would be $740. This means I need to sell my 500# calf for at least $2,040 every year for the next 5 years.

• Given I only get to sell 1 calf each year, I'd prefer to see a 10% ROI on my $2040 annual investment, making my breakeven on that weaned 500# calf $4.50, and that's a steer and heifer average.

The cow calf sector might look like the safest play on paper right now, but I'm not sure I'd bet on calf prices staying this high for 5 years straight. To be honest, I think feeding hogs looks like a safest bet for the moment. Or maybe slinging meat at the local Fareway is the best place to be right now. I will say, the retailer usually loses a little in the 2nd quarter selling beef, but I'm willing to bet their margins on hamburger buns and Busch Latte's make up for that loss. The moral of the story is we all have tough periods, but eventually get our day in the sun. I'm glad the rancher is getting their day, it's been long overdue.

Who knows what next week or next year will bring. Maybe those examples above will show great closeouts and ROI. I think we should all do our part to make that happen by eating 3 steaks and a pound of bacon this weekend. Ok ok, you don't have to twist my arm, I'll do it. Have a good weekend.

-Fat cattle kill at 86,000 vs 85,000 a week ago and 101,000 a year ago

-Choice boxes down .37 to $364.47 and select up .39 to $363.42 for a spread of 1.05 on 60 loads

-CME feeder index(Feeder LRP Settlement) for 2/12 came in at $373.91

-Fed Cattle LRP’s ending last week settled at $240.97

-Hog kill at 446,000 vs 490,000 a week ago and 477,000 a year ago.

-Afternoon Pork reported down .49 at $95.16 on 253 loads

-CME lean hog index on 2/11 reported at 86.89

-CME pork cutout index on 2/12 reported at 94.99

-LRP’s ending 2/13 settled at approximately $86.93

Click here to connect with a CattleUSA Insurance representative

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.

Review our full disclaimer at https://www.logicag.com/disclaimer

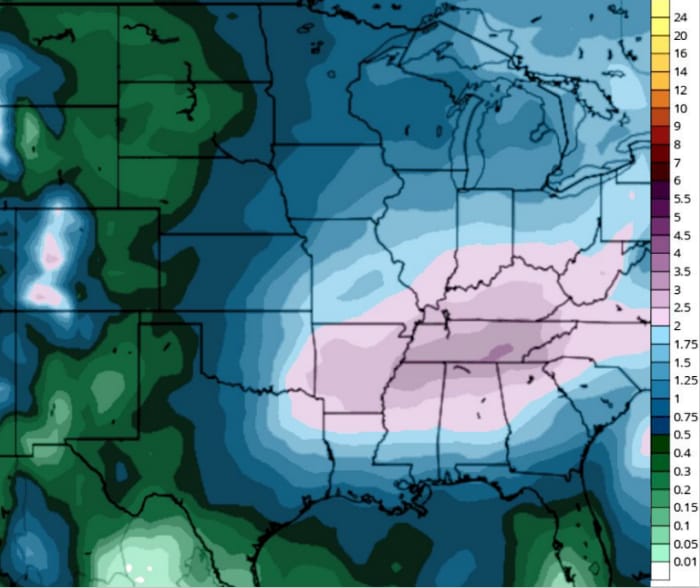

Most grain areas may see 0.25”-1” liquid. 2”-4” is possible across the southern ECB, TN valley to southeast USA. This will help some drought areas. Dakotas to west TX will see 0.10”-0.50” with a chance to see 0.25”-1” in some locations.

CattleUSA has teamed up with Weather 20/20 to bring you exclusive access to long-range weather forecasts using their patent-pending LRC methodology. Plan ahead with confidence and stay ahead of the weather—now at a special discounted rate for CattleUSA users!

Florida Board Boosts Cattle Genetics

The Florida Cattle Enhancement Board strengthens ties between ranchers and researchers by funding projects that improve herd health, genetics and productivity. A key success is the University of Florida Brahman Project, advancing marbling, tenderness, disposition and genetic performance to better serve Florida producers. read more here

Embryos Boost Commercial Herd Efficiency

With cow numbers low and efficiency critical, commercial producers are turning to F1 replacement heifer embryos. The strategy captures maximum heterosis, improves uniformity and fertility, reduces replacement costs and allows the rest of the herd to be bred strictly for terminal merit—boosting long-term productivity and profit. read more here

Udder Quality Impacts Calf Profits

Extension specialists stress that beef cow udder quality should be evaluated at calving, when teat size, attachment and milk flow are easiest to assess. Poor udders and mastitis reduce milk production, weaken calves and cut weaning weights—costing producers valuable dollars amid strong calf prices. read more here

Friday, February 13

| MARKETS | PRICE | CHANGE | PERCENT |

| DOW | 49,500.93 | + 48.95 | 0.10% ▲ |

| S&P 500 | 6,836.17 | + 3.41 | 0.05% ▲ |

| NASDAQ | 22,546.67 | - 50.48 | 0.22% ▼ |

| Russell 2000 | 2,646.70 | + 30.87 | 1.18% ▲ |

| Gold | 5,063.00 | + 114.60 | 2.32% ▲ |

| Silver | 77.40 | + 1.72 | 2.27% ▲ |

| Bitcoin | 68,861.00 | + 2,696.00 | 4.07% ▲ |

| Crude Oil | 62.83 | - 0.01 | 0.02% ▼ |

Cattle Chop, Await Cash Breakout

Cattle futures are choppy and need higher cash—above $245 in the South—to push to new highs. Strong carcass weights and plant news add caution, but spring demand could fuel a rally. Hogs corrected on trade fears yet retain upside potential, while grains see profit-taking ahead of the holiday. read more here

Exports Keep Corn Prices Supported

Strong export demand continues to support corn prices into 2026, says Compeer’s Megan Roberts. While prices remain below producer targets, they’d likely be weaker without exports. Potential nationwide E15 use and fewer planted acres could add future support, though ethanol policy gains aren’t expected near term. read more here

Demand Lifts Crops, Hogs Slide

Grains rebounded on strong exports and weather threats in U.S. wheat and Brazil soybeans. Nat gas rose on cold-driven storage draws but milder forecasts may cap gains. Strong jobs data pressured gold and silver. Coal rules may ease. Hogs briefly hit $1 before plunging on heavy selling. read more here

CattleUSA Daily Podcast:

If you or someone you know would be interested in hopping on the mic to share your story, please contact us at [email protected]. — Video streaming weekdays on YouTube @cattleusatv. Audio available on Spotify, Apple Podcasts & all major streaming platforms.

Happy President’s Day!

Want more CattleUSA? Check out our socials!

-

Questions, comments, concerns? Reply to this email or message us at [email protected]—we’d love to hear from you!

Premium Membership Details

Become a Premium member of the CattleUSA Drive Community for full access to this post and other member-only content.

Click Here to Upgrade AccountPremium Membership Includes:

- Daily Market Insights

- Daily Feeder Cattle Index

- Daily Inspirational Thought

- Insider Expert Commentary

- Predictive Weather Forecasting by Weather 20/20

- Latest Industry News & Updates

- The Saturday Edition

- Full Access to All Content & Archive

- Access to Exclusive Content & Events

- CattleUSA Partner Discounts

- Community Contributions & Insights

- + More!