- LIMITED PREMIUM ACCESS -

“Every piece of the universe, even the tiniest little snow crystal, matters somehow.

I have a place in the pattern, and so do you.”

— T.A. Barron

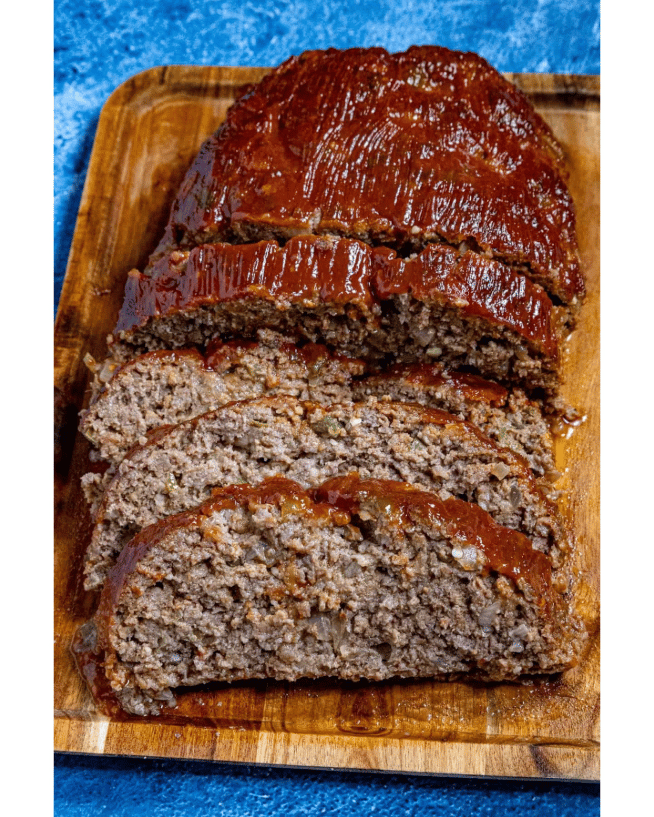

#BOTW - BEEF OF THE WEEK

MARKET REPORT

WEATHER 20/20 REPORT

AGRICULTURE

CONSERVATION GRAZING DEBATE AT POINT REYES

USDA REORGANIZATION DRAWS BROAD PUSHBACK

OSU LAUNCHES ANIMAL EXCELLENCE INITIATIVE

FINANCE

DAILY REPORTING

2025 CATTLE AND BEEF REVIEW

CORN FIRMS, BEANS VOLATILE

ECONOMIST SEES FLAT COMMODITY PRICES

Looking for some comfort food to whip up? Your search ends here! This week’s #BOTW is a tender and juicy Southern style meatloaf topped with a sweet and tangy glaze. Cookbook author Mike over at Chili Pepper Madness crafted this delish dish AND shared his recipe online!

No one will be saying “meatloaf, smeatloaf, double-beatloaf” after trying out this recipe!

What would you rate this #BOTW?

P.S. Know of a dish worth featuring? DM us on Instagram @cattleusa.media with your submission—we might showcase it next!

Close

349.79

Previous

348.85

Change

0.94 ▲

Wednesday, December 17

AUCTION SUMMARY

Beaver Livestock

6,758 Beaver, OK

Tuesday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 457.00-531.00 | 400-500 lbs | 441.00-477.50 |

| 600-700 lbs | 405.00-450.00 | 500-600 lbs | 407.50-436.00 |

| 700-800 lbs | 347.50-396.00 | 600-700 lbs | 352.00-379.00 |

| 800-900 lbs | 338.00-363.00 | 700-800 lbs | 333.00-354.00 |

| 900-1000 lbs | 315.00-323.00 | 800-900 lbs | 318.00-325.00 |

OKC West Livestock

5,000 El Reno, OK

Tuesday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 400-500 lbs | 460.00-570.00 | 200-300 lbs | 540.00-630.00 |

| 500-600 lbs | 420.00-490.00 | 300-400 lbs | 460.00-560.00 |

| 600-700 lbs | 355.00-440.00 | 400-500 lbs | 420.00-490.00 |

| 700-800 lbs | 350.00-390.00 | 500-600 lbs | 370.00-425.00 |

| 800-900 lbs | 338.00-348.00 | 600-700 lbs | 335.00-380.00 |

Winter Livestock

4,282 La Junta, CO

Tuesday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 424.00-479.00 | 400-500 lbs | 432.50-485.00 |

| 600-700 lbs | 370.00-428.00 | 500-600 lbs | 352.50-415.00 |

| 700-800 lbs | 335.00-366.50 | 600-700 lbs | 330.00-352.00 |

| 800-900 lbs | 313.00-343.00 | 700-800 lbs | 320.00-326.00 |

| 900-1000 lbs | 309.00-315.00 | 800-900 lbs | 290.50-309.00 |

CHICAGO MERCANTILE EXCHANGE LIVESTOCK FUTURES SETTLEMENT

Wednesday

| Live Cattle | Change | Feeder Cattle | Change | ||

| Dec | 230.300 | 0.850 ▼ | Jan | 341.525 | 1.800 ▼ |

| Feb | 229.550 | 1.150 ▼ | Mar | 336.325 | 1.275 ▼ |

| Apr | 229.125 | 1.150 ▼ | Apr | 335.025 | 1.275 ▼ |

CHICAGO BOARD OF TRADE GRAIN FUTURES SETTLEMENTS

Wednesday

| Corn | Change | Soy Beans | Change | ||

| Mar | 4.4050 | 0.0400 ▲ | Jan | 10.5825 | 0.0450 ▼ |

| May | 4.4775 | 0.0325 ▲ | Mar | 10.6875 | 0.0300 ▼ |

| Jul | 4.5350 | 0.0250 ▲ | May | 10.8000 | 0.0300 ▼ |

KANSAS CITY BOARD OF TRADE

Wednesday

| Wheat | Change | ||||

| Mar | 5.0775 | 0.0275 ▲ | |||

| May | 5.2025 | 0.0275 ▲ | |||

| Jul | 5.3350 | 0.0225 ▲ | |||

ESTIMATED DAILY CATTLE SLAUGHTER

| Wednesday | 118,000 | Tuesday |

| Week Ago (est) | 123,000 | Steer & Heifer: 98,000 |

| Year Ago (act) | 123,000 | Cow & Bull: 23,000 |

| Wk To Date (est) | 349,000 | |

| Last Week (est) | 361,000 | |

| Last Year (est) | 362,000 |

Wednesday, December 17

5 AREA WEEKLY ACCUMULATED WEIGHTED AVG CATTLE PRICE

| As of 10:00 am | Head Count | Avg Weight | Avg Price |

| Live Steer | 147 | 1,407 | 229.00 |

| Live Heifer | 412 | 1,250 | 229.00 |

| Dressed Steer | - | - | - |

| Dressed Heifer | - | - | - |

DAILY ESTIMATED CUTOUT VALUES

| 600-900# | Choice | Select | Choice/Select Spread |

| Current Cutout Values: | 356.09 | 346.43 | 9.66 |

| Change from prior day: | -2.79 ▼ | -2.67 ▼ |

DAILY CATTLE SLAUGHTER

| Wednesday | 118,000 | Tuesday |

| Week Ago | 123,000 | Steer & Heifer: 98,000 |

| Year Ago (act) | 122,529 | Cow & Bull: 23,000 |

| Week To Date | 349,000 | |

| Same Period Last Week | 361,000 | |

| Same Period Last Year | 362,062 |

Wednesday, December 17

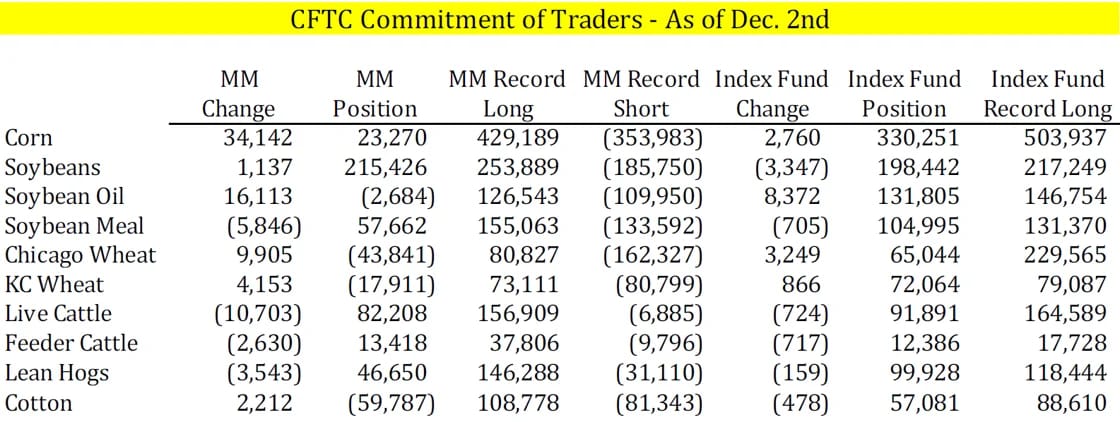

CattleUSA Insurance Partner Logic Ag Marketing Commentary

We're finally getting somewhere with the "delayed data dump" following the government shutdown. Up until today, it wasn't worth sharing data that was 2 months behind. Someone should remind the government that it's a futures market, not a past market and we need the current data. I digress. As of December 2nd, Managed Money continued their liquidation of Live Cattle and Feeder Cattle long positions, getting to a net 82,208 longs in fats, and 13,418 in feeders, very close to our estimates based on Open Interest reports. Hopefully we'll get the more recent 2 weeks worth of data before year, if we're lucky.

Since it is tax season for many of you producers, I feel obligated to remind you how your positions on the board could play a role against your year end. For example, buying a put or call option, depending on your accountant, can be considered an expense this year. Same with LRP's if you're inclined to prepay. On the opposite side, if you're an option seller, with open positions, once again depending on your accountant, those sold puts or calls could be considered income against your 2025 books, even though they're not closed out until 2026. Given our current livestock environment, buying a put, or a pre-paid LRP, could be beneficial in multiple ways. I don't like financial surprises, so if you have questions, reach out.

-Fat cattle kill at 118,000 vs 123,000 a week ago and 122,000 a year ago

-Choice boxes down 2.79 to $356.09 and select down 2.67 to $346.43 for a spread of 9.66 on 170 loads

-CME feeder index(Feeder LRP Settlement) for 12/16 came in at $349.79

-Fed Cattle LRP’s ending last week settled at $227.90

-Hog kill at 494,000 vs 490,000 a week ago and 486,000 a year ago.

-Afternoon Pork reported down .02 at $98.54 on 240 loads

-CME lean hog index on 12/15 reported at 83.30

-CME pork cutout index on 12/16 reported at 98.31

-LRP’s ending 12/17 settled at approximately $83.87

Click here to connect with a CattleUSA Insurance representative

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.

Review our full disclaimer at https://www.logicag.com/disclaimer

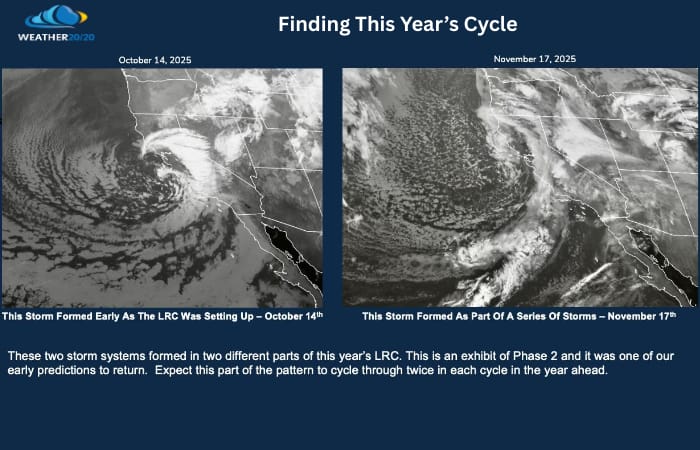

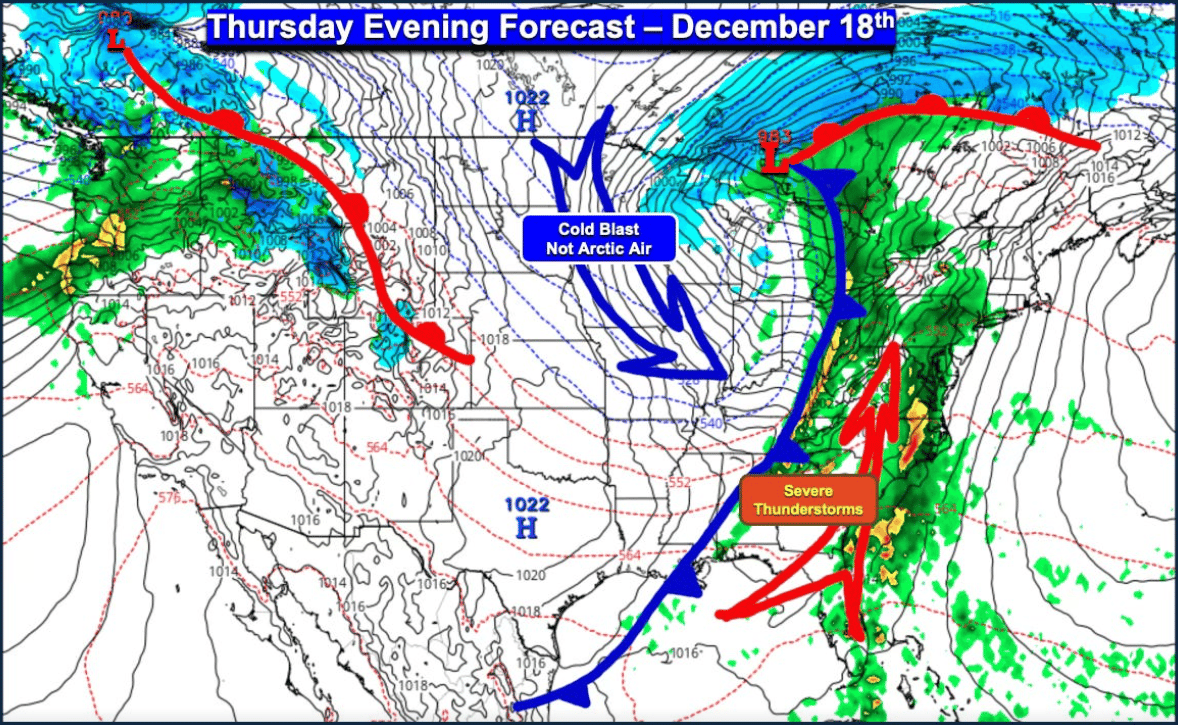

These two storm systems formed in two different parts of this year’s LRC. This is an exhibit of Phase 2 and it was one of our early predictions to return. Expect this part of the pattern to cycle through twice in each cycle in the year ahead.

The part of the pattern that produced storm systems earlier this season is about to cycle back through once again. The slide above shows a strong California storm on October 14, followed by a similar system on November 17. Now, a storm with a comparable structure is beginning to show up in the model guidance as we approach Christmas week. We’ll discuss that in just a moment.

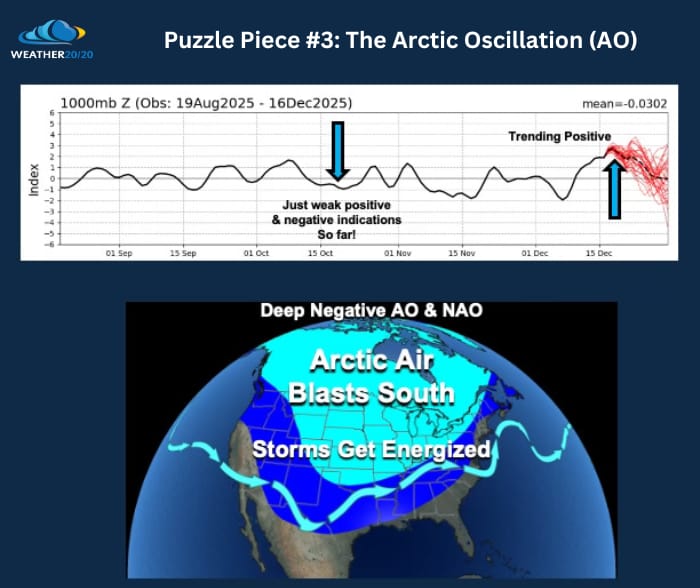

While the LRC defines when the pattern returns, the NAO and AO help determine how it expresses itself—modulating storm strength, track, and temperature contrasts.

Let’s first look at a couple of the fringe pieces of the puzzle—the NAO and AO.

• The AO & NAO are important indexes to track as they showcase potential cold and warm periods and how strong storms may be.

• When these indexes dip deep negative, below -3 to -4, there is a much better chance that Arctic air will blast south. This energizes the jet stream and may increase the strength of storm systems.

• When these indexes rise into the positive territory, especially above +3 to +4, Arctic air is most likely to be held far to the north and storm systems end up weaker, and this happened in the first cycle of this year’s LRC.

• We are monitoring this influence on the overall weather pattern closely. The positive shift is affecting the models forecasters use in weather prediction

The NAO and AO help determine how this recurring pattern expresses itself—shaping storm strength, track, and temperature contrasts—without changing the underlying LRC itself. That’s one huge point: Regardless of where the AO, NAO, ENSO, and other corner pieces of the puzzles are in their phases, the LRC continues to cycle on schedule.

The Arctic Oscillation (AO) has trended positive, as shown on the slide above. This is likely influencing the current look of the forecast models, including the GFS, European, and other guidance. Over the next week, the AO is forecast to trend back toward neutral.

As that transition occurs, the models you’re seeing today will likely evolve—potentially toward a stronger storm entering California, which in turn would support the significant warm-up we are highlighting.

These are some of the deeper, day-to-day insights we’re watching behind the scenes as the pattern unfolds.

Now, let’s take a closer look at how this evolving forecast fits into the holiday week and the official start of winter.

By Thursday, as shown on the slide below, the focus shifts farther south and east. A line of thunderstorms is expected to track across the Tennessee Valley, and some of these storms could become severe, adding another layer of impact as the pattern continues to evolve.

Then, look at what happens a few days later by Christmas Day:

CattleUSA has teamed up with Weather 20/20 to bring you exclusive access to long-range weather forecasts using their patent-pending LRC methodology. Plan ahead with confidence and stay ahead of the weather—now at a special discounted rate for CattleUSA users!

Conservation Grazing Debate At Point Reyes

The Nature Conservancy plans short-term targeted cattle grazing on former Point Reyes ranchlands to control invasive purple velvet grass. Supporters say adaptive grazing can restore habitat, while former ranchers warn absentee, short-term contracts may undermine long-term stewardship and ecosystem care. read more here

USDA Reorganization Draws Broad Pushback

USDA received nearly 47,000 comments on its proposed reorganization, with 82% negative. Stakeholders warned of lost local expertise, weakened Forest Service capacity, and risks to ag research. Common recommendations urged more transparency, stronger local offices, protected research funding, and delaying or revising the plan. read more here

OSU Launches Animal Excellence Initiative

Oklahoma State University launched the Animal Excellence initiative, highlighted by a new Beef Center of Excellence to unite research, Extension, and teaching across the beef supply chain. The effort includes endowed chairs, facility upgrades and industry partnerships to strengthen animal health, sustainability and producer profitability. read more here

Wednesday, December 17

| MARKETS | PRICE | CHANGE | PERCENT |

| DOW | 47,885.97 | - 228.29 | 0.47% ▼ |

| S&P 500 | 6,721.43 | - 78.83 | 1.16% ▼ |

| NASDAQ | 22,693.32 | - 418.14 | 1.81% ▼ |

| Russell 2000 | 2,492.29 | - 27.01 | 1.07% ▼ |

| Gold | 4,376.40 | + 44.10 | 1.02% ▲ |

| Silver | 66.73 | + 3.41 | 5.39% ▲ |

| Bitcoin | 85,857.00 | - 1,885.00 | 2.15% ▼ |

| Crude Oil | 56.76 | + 1.63 | 2.96% ▲ |

2025 Cattle And Beef Review

U.S. cattle inventories fell to 86.7 million head in 2025, the lowest since the 1950s, tightening supplies across the beef chain. Feedlot placements, slaughter and beef production are down, driving sharply higher cattle and beef prices. Herd rebuilding incentives exist, but high costs and uncertainty point to a slow recovery and continued price support. read more here

Corn Firms, Beans Volatile

Corn futures strengthened on record ethanol production and fresh export sales to Mexico, while soybeans rebounded from deeply oversold levels despite ongoing pressure. Wheat was mixed amid Chinese cancellations, and livestock futures slipped as cash trade remained undeveloped and technical resistance weighed on cattle and hog markets. read more here

Economist Sees Flat Commodity Prices

University of Illinois economist Joe Janzen expects corn and soybean prices to stay low and stable in 2026, citing large U.S. supplies, record South American production, and trade uncertainty. He advises farmers to spread sales across wider windows to manage price risk. read more here

CattleUSA Daily Podcast:

Today’s Affirmation:

I can let go of what I can’t control.

-

Want more CattleUSA? Check out our socials!

-

Have thoughts on what we should tweak next? Reply to this email or message us at [email protected]—we’d love to hear from you!