- LIMITED PREMIUM ACCESS -

“Follow effective action with quiet reflection.

From the quiet reflection will come even more effective action.”

— Peter F. Drucker

WEDNESDAY WIRE

MARKET REPORT

WEATHER 20/20 REPORT

AGRICULTURE

INTEGRITY DEFINES BEEF LEADERSHIP

ONLINE COURSE BUILDS RANCH PROFITABILITY

ARKANSAS COVER CROP ADOPTION GROWS

FINANCE

DAILY REPORTING

EXPORT DIVERSIFICATION RESHAPES MARKETS

GRAINS SLIDE, LIVESTOCK STEADY

METAL PRICES FACE TIGHT SUPPLY

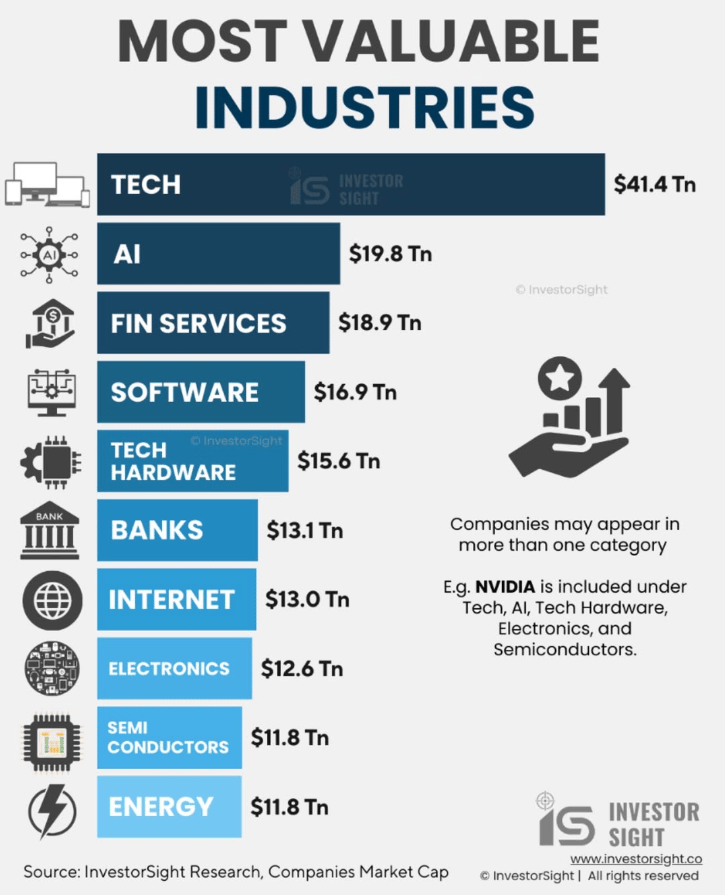

With all the news about tech, artificial intelligence, and ag becoming increasingly intertwined, it’s no surprise that technology is the most valuable global industry by market cap. Since June 2025, Electronics and Semiconductors have also moved ahead of Energy, with overlapping company representation—such as NVIDIA—boosting multiple tech-related categories.

Join the conversation - comment online!

|

P.S. - Have a chart or trend you think should be featured in next week’s Wednesday Wire? DM us on Instagram @cattleusa.media with your submission! |

Close

347.37

Previous

346.77

Change

0.6 ▲

Tuesday, December 16

AUCTION SUMMARY

Joplin Regional Stockyards

11,705 Carthage, MO

Monday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 395.00-470.00 | 400-500 lbs | 390.00-500.00 |

| 600-700 lbs | 360.00-417.00 | 500-600 lbs | 355.00-412.50 |

| 700-800 lbs | 340.00-375.00 | 600-700 lbs | 337.00-379.00 |

| 800-900 lbs | 321.00-357.00 | 700-800 lbs | 316.00-350.00 |

| 900-1000 lbs | 315.00-325.00 | 800-900 lbs | 297.00-316.00 |

Oklahoma National Stockyards

8,500 Oklahoma City, OK

Monday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 400-500 lbs | 447.50-540.00 | 300-400 lbs | 470.00-595.00 |

| 500-600 lbs | 408.00-482.00 | 400-500 lbs | 417.00-475.00 |

| 600-700 lbs | 363.00-421.00 | 500-600 lbs | 360.00-440.00 |

| 700-800 lbs | 340.00-381.00 | 600-700 lbs | 329.00-370.00 |

| 800-900 lbs | 330.00-355.00 | 700-800 lbs | 309.00-337.00 |

Souix Falls Regional

6,062 Worthing, SD

Monday

| Feeder Steers - Medium & Large #1 | Feeder Heifers - Medium & Large #1 | ||

| 500-600 lbs | 425.00-520.00 | 400-500 lbs | 435.00-500.00 |

| 600-700 lbs | 376.00-440.00 | 500-600 lbs | 365.00-457.50 |

| 700-800 lbs | 365.00-418.00 | 600-700 lbs | 358.00-407.50 |

| 800-900 lbs | 334.00-358.00 | 700-800 lbs | 328.00-380.00 |

| 900-1000 lbs | 324.00-346.00 | 800-900 lbs | 304.00-336.00 |

CHICAGO MERCANTILE EXCHANGE LIVESTOCK FUTURES SETTLEMENT

Tuesday

| Live Cattle | Change | Feeder Cattle | Change | ||

| Dec | 231.150 | 0.325 ▲ | Jan | 343.325 | 3.400 ▲ |

| Feb | 230.700 | 0.150 ▲ | Mar | 337.600 | 2.750 ▲ |

| Apr | 230.275 | 0.250 ▲ | Apr | 336.300 | 2.525 ▲ |

CHICAGO BOARD OF TRADE GRAIN FUTURES SETTLEMENTS

Tuesday

| Corn | Change | Soy Beans | Change | ||

| Mar | 4.3650 | 0.0325 ▼ | Jan | 10.6275 | 0.0900 ▼ |

| May | 4.4450 | 0.0325 ▼ | Mar | 10.7175 | 0.0950 ▼ |

| Jul | 4.5100 | 0.0275 ▼ | May | 10.8300 | 0.1000 ▼ |

KANSAS CITY BOARD OF TRADE

Tuesday

| Wheat | Change | ||||

| Mar | 5.0500 | 0.0700 ▼ | |||

| May | 5.1750 | 0.0675 ▼ | |||

| Jul | 5.3125 | 0.0625 ▼ | |||

ESTIMATED DAILY CATTLE SLAUGHTER

| Tuesday | 121,000 | Monday |

| Week Ago (est) | 123,000 | Steer & Heifer: 91,000 |

| Year Ago (act) | 123,000 | Cow & Bull: 19,000 |

| Wk To Date (est) | 231,000 | |

| Last Week (est) | 238,000 | |

| Last Year (est) | 240,000 |

Tuesday, December 16

5 AREA WEEKLY ACCUMULATED WEIGHTED AVG CATTLE PRICE

| As of 10:00 am | Head Count | Avg Weight | Avg Price |

| Live Steer | - | - | - |

| Live Heifer | - | - | - |

| Dressed Steer | - | - | - |

| Dressed Heifer | - | - | - |

DAILY ESTIMATED CUTOUT VALUES

| 600-900# | Choice | Select | Choice/Select Spread |

| Current Cutout Values: | 358.88 | 349.10 | 9.78 |

| Change from prior day: | -0.58 ▼ | +1.80 ▲ |

DAILY CATTLE SLAUGHTER

| Tuesday | 121,000 | Monday |

| Week Ago | 123,000 | Steer & Heifer: 91,000 |

| Year Ago (act) | 122,598 | Cow & Bull: 19,000 |

| Week To Date | 231,000 | |

| Same Period Last Week | 238,000 | |

| Same Period Last Year | 239,533 |

Tuesday, December 16

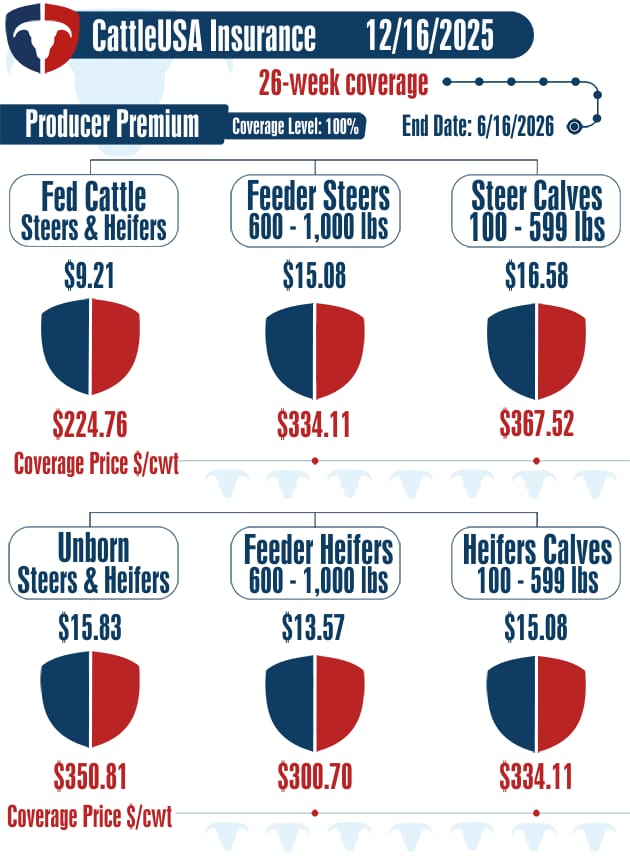

CattleUSA Insurance Partner Logic Ag Marketing Commentary

Good afternoon. I'll make an early guess and call for cash steady to higher this week in the fats. I haven't seen or heard of any bids yet, It's just my guess for the week. I didn't have anything else constructive to say today. So, here's my attempt to get everyone in the Christmas spirit, via the afternoon livestock newsletter!

’Twas the close of the session when all through the ring,

Not a trade was left waiting, not a last-minute swing.

The cattle sat steady with a soft winter tone,

While feeders watched corn and the charts on the phone.

The hogs moved in choppy, on headlines and fear,

With talk of demand in the new calendar year.

Packers weighed margins, the plants ran their pace,

As spreads in the board tried to find a new base.

Feed costs still linger like snow on the eaves,

With corn and protein keeping weight on the sleeves.

Yet basis and breakevens still tell you the tale,

Of when to add coverage and when to just scale.

So hedge when you’re able, stay patient, stay bright,

Use tools to protect you when markets take flight.

With a plan and good discipline through each market storm,

You can keep floors in place while you leave upside nice and warm.

Have a great night!

-Fat cattle kill at 121,000 vs 123,000 a week ago and 123,000 a year ago

-Choice boxes down .58 to $358.88 and select up 1.80 to $349.10 for a spread of 9.78 on 119 loads

-CME feeder index for 12/12 came in at $347.37

-LRP’s ending last week settled at $227.90

-Hog kill at 494,000 vs 493,000 a week ago and 489,000 a year ago.

-Afternoon Pork reported down .33 at $98.56 on 273 loads

-CME lean hog index on 12/12 reported at 82.99

-CME pork cutout index on 12/15 reported at 97.88

-LRP’s ending 6/5 settled at $83.39

Click here to connect with a CattleUSA Insurance representative

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.

Review our full disclaimer at https://www.logicag.com/disclaimer

INTERNATIONAL PRECIPITATION NEXT 15 DAYS

• Australia - Trace-0.50” west | 0.50”-2” for NSW

• Canada - 0.10-1”

• China - Trace-0.50”

• Europe - 0.10”-0.50” for all areas

• Russia (pictured below) - 0.10”-0.80” is possible southeast of the Sea of Azov | 0.50”-2” is possible in the rest of the North Caucasus region | The Central/Volga region will see 0.25”-1

CattleUSA has teamed up with Weather 20/20 to bring you exclusive access to long-range weather forecasts using their patent-pending LRC methodology. Plan ahead with confidence and stay ahead of the weather—now at a special discounted rate for CattleUSA users!

Integrity Defines Beef Leadership

Bill Rishel’s career in the beef industry was shaped by unwavering integrity, science-based decisions, and service. A pioneer in Angus genetics and carcass merit, he influenced every segment of the industry while mentoring young producers and building a legacy grounded in doing what’s right. read more here

Online Course Builds Ranch Profitability

Noble Research Institute launched Noble Profitability Essentials Online, a self-paced course helping ranchers strengthen financial management. The program covers budgeting, cash flow, and goal alignment using real ranch data, offering flexible access, practical tools, and ongoing support nationwide. read more here

Arkansas Cover Crop Adoption Grows

Researchers using satellite imagery found Arkansas farmers increased voluntary cover crop adoption by 5%, adding about 36,000 acres. The study showed cover crops most often paired with soybean rotations, highlighting economic and soil health benefits beyond government incentives. read more here

Tuesday, December 16

| MARKETS | PRICE | CHANGE | PERCENT |

| DOW | 48,114.26 | - 302.30 | 0.62% ▼ |

| S&P 500 | 6,800.26 | - 16.25 | 0.24% ▼ |

| NASDAQ | 23,111.46 | + 54.05 | 0.23% ▲ |

| Russell 2000 | 2,519.30 | - 11.36 | 0.45% ▼ |

| Gold | 4,332.70 | - 2.50 | 0.06% ▼ |

| Silver | 63.70 | + 0.12 | 0.18% ▲ |

| Bitcoin | 87,629.00 | + 1,251.00 | 1.45% ▲ |

| Crude Oil | 55.15 | - 1.67 | 2.94% ▼ |

Export Diversification Reshapes Markets

U.S. export data through October 2025 shows diversification reshaping corn and soybean markets. Soybean exports declined as China’s share fell, but gains in other regions softened losses. Corn exports grew despite weaker top buyers, with broader demand driving higher volumes. read more here

Grains Slide, Livestock Steady

Grain markets weakened Tuesday as corn, soybeans and wheat fell on a risk-off tone, pressured by crude oil losses, technical selling and no fresh China soybean sales. Corn tested key support while soybeans filled chart gaps. Livestock traded mixed to higher with feeder cattle leading gains. read more here

Metal Prices Face Tight Supply

The World Bank says metal prices steadied in November after strong gains, supported by resilient demand and tight supply, especially for copper and aluminum. Prices are expected to firm through 2027 as supply constraints persist, though weaker global growth—particularly in China—poses the biggest downside risk. read more here

CattleUSA Daily Podcast:

It’s National Maple Syrup Day!

If you can’t tap your own, store-bought is fine 😄

-

Want more CattleUSA? Check out our socials!

-

Have thoughts on what we should tweak next? Reply to this email or message us at [email protected]—we’d love to hear from you!